Big Questions For Any ESPN ‘Strategic Partner’

Disney CEO Bob Iger made waves when he revealed interest in finding “strategic partners” for ESPN in an interview with CNBC.

After years of ESPN printing money for Disney’s cable offerings, that ship has seemingly sailed. Meanwhile, rights fees to air live sporting events only continue to soar — which is a particular problem for ESPN, whose existence is largely predicated on airing them.

Things get even hairier for “the worldwide leader in sports” when factoring in the upcoming direct-to-consumer app that will skirt around MVPDs and allow users to just get ESPN directly through an app for the first time, without having to subscribe to it through a larger bundle.

That gives ESPN a roadmap to exist in a post-cable world. But also lets cable exist in a post-ESPN world, which could mean some initial struggles for Disney as it tries to break even (at least) without the MVPD carriage fees that have long buoyed ESPN.

To that end, strategic partners could help Disney absorb fewer losses (since it wouldn’t be solely responsible for them), while also regaining some leverage in the aforementioned media rights deals.

Reporting in the last week revealed that ESPN has already held talks with the NFL, NBA and MLB about minority investment stakes as part of said strategic partnerships. Presumably the list won’t be limited to those leagues. But the idea of ESPN getting even deeper into business with these long-time partners did spur some questions — which we dive into below:

Which league partners make the most sense?

The key question starts at what we know — that talks were already started with the NFL, NBA and MLB. Noticeably absent there is the NHL. But otherwise, this is an accurate picture of the leagues that are most heavily tied to ESPN already.

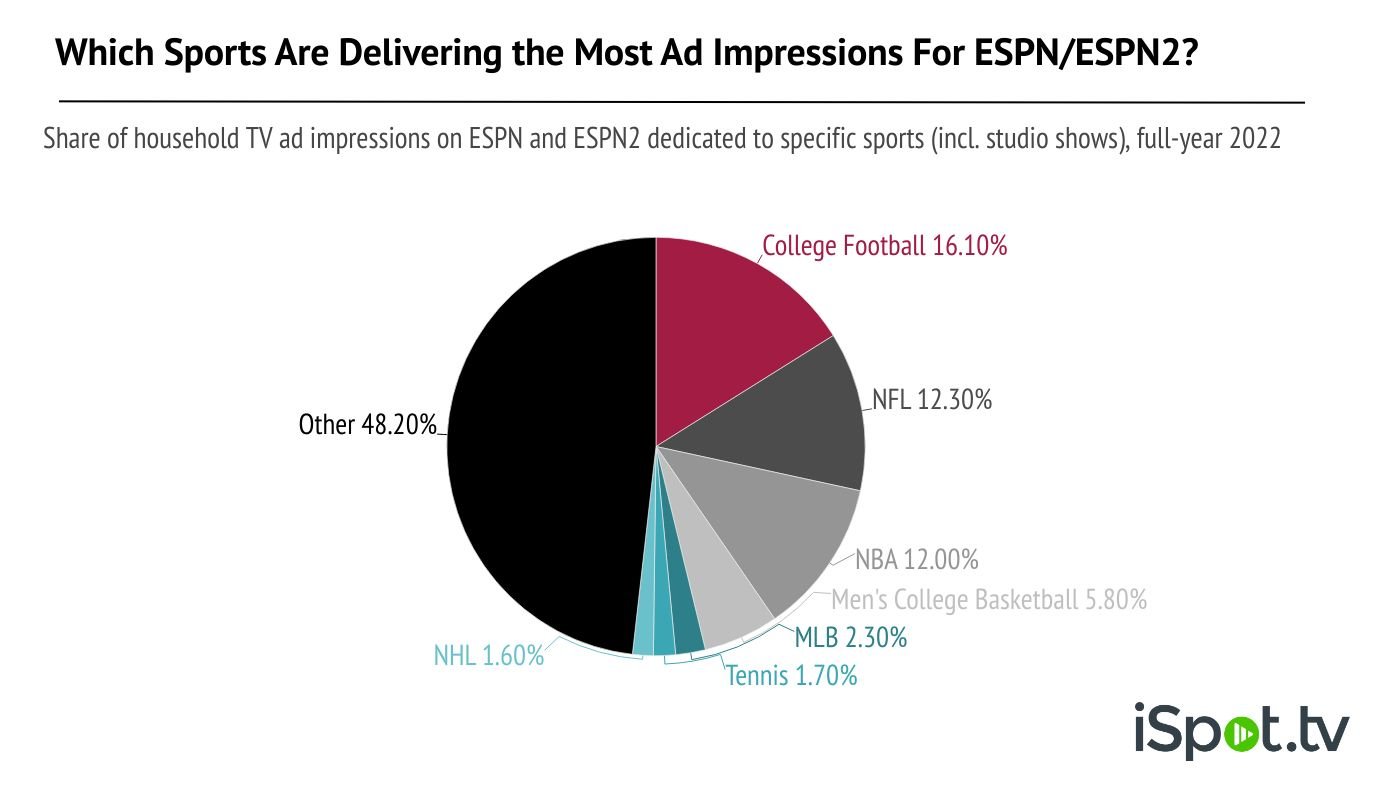

The chart below looks back at iSpot data from 2022 to reveal which sorts of programming delivers the highest share of household TV ad impressions across ESPN and ESPN2. Of note, each sport/league’s totals include live competitions as well as syndicated airings and studio shows dedicated specifically to that sport (i.e. NFL Live is included in the larger NFL total).

So the NFL, NBA and MLB do account for the highest shares of ad impressions among professional leagues, and thus, make the most sense. But it’s interesting to see tennis in there, too.

Could the ATP (Association of Tennis Professionals) be a potential partner that would earn some upside here? Or maybe even options further down the list like Formula 1, which has already experienced a significant amount of growth on ESPN (and ABC) in recent years?

Another option could be the powers-that-be in college sports, should the top conferences or programs ever break away from the NCAA (a distinct and increasing possibility). ESPN has long been invested in college sports and has been fundamental in the growth of college football, in particular, as a national sports product. Investing with ESPN could also help college football conferences potentially end the charade of non-profit distinctions and amateurism, and potentially even help with the current name, image and likeness (NIL) struggles.

How much of a minority share are we talking about?

Related to the above: We don’t really know anything about price or how much is even up for sale for these leagues. Those numbers could render some of the discussions around lower-tier sports moot, and maybe they already have given the fact that the NFL, NBA and MLB already appear to be at the front of the line.

What would this mean for coverage?

Like any sports network, ESPN is in business with its reporting subject matter. And while there’s a figurative separation of church and state in play when it comes to reporting on less positive stories regarding sports figures and leagues, it does exist — in large part because the sports and the coverage of them remain distinct entities.

But… what if they weren’t, as would be the case with any minority stake sold here?

The leagues probably wouldn’t hate it to negotiate either more coverage or more favorable coverage, if it were on the table. It becomes a greater problem for the leagues that aren’t invested in ESPN, should they start to feel like they’re getting short shrift relative to those that are.

From a journalistic standpoint, any perceptible coverage adjustments become yet another instance of independent journalism eroding in favor of access and/or wider-scale business dealings. That’s probably a larger concern for fans and reporters than the networks or leagues, however. So it’s debatable how much it gets factored into any deeper parntership.

What about competitive network conflicts?

If any of these entities (large or small) were a minority owner of ESPN, it does create some friction with the numerous other networks all of the leagues appear on.

For instance: The NFL accounted for over 30% of all household TV ad impressions across FOX and Fox Sports 1 last year, according to iSpot. Does Fox still feel as enthusiastic about its big bet on the NFL if it’s technically in competition with the league itself through that ESPN investment?

When it comes to college sports, ESPN and Fox, in particular, have seemingly built walls around certain game rights. But for the “big four” sports in the U.S., rights are split across multiple networks.

One could assume — with no inside knowledge whatsoever here — that ESPN would also have the inside track on rights negotiations with invested leagues. That could mean discounted rates that other networks can’t afford to compete with, or game inventory skews that put a more entertaining product on ESPN (and/or ESPN2 and ABC).

That doesn’t seem ideal for other networks, unless they arranged for similar ownership stakes themselves.

Could they? Sure. But then at that point, have we just eliminated the idea of independent coverage? And how much does that hurt the presentation of the product?

Since ESPN’s partner discussions are in their infancy, there’s likely a long road ahead. But what happens next is likely to create a considerable shift in what both ESPN and cable sports’ futures look like.