HBO Max, Disney+ Bet On Premium Puts Pressure On Competition

With early data suggesting the Disney+ and HBO Max bets on premium content are paying off, it's likely lesser competitors are again recalibrating spending plans as they pivot to the streaming future. The question is whether they can afford the bill in competing against some of the world's biggest tech and entertainment powerhouses.

New surveys from Hub Entertainment Research's Hub TV Churn Index showed a marked upswing in consumer interest in HBO Max after it announced it would release all of its 2021 slate of movies simultaneously in theaters and on the streamer.

Among consumers who added any new TV subscription, 13 percent said signed up for HBO Max in December, when the day-and-date announcement came out. That was nearly double the 7-percent share of new subscribers attracted the month before the big announcement.

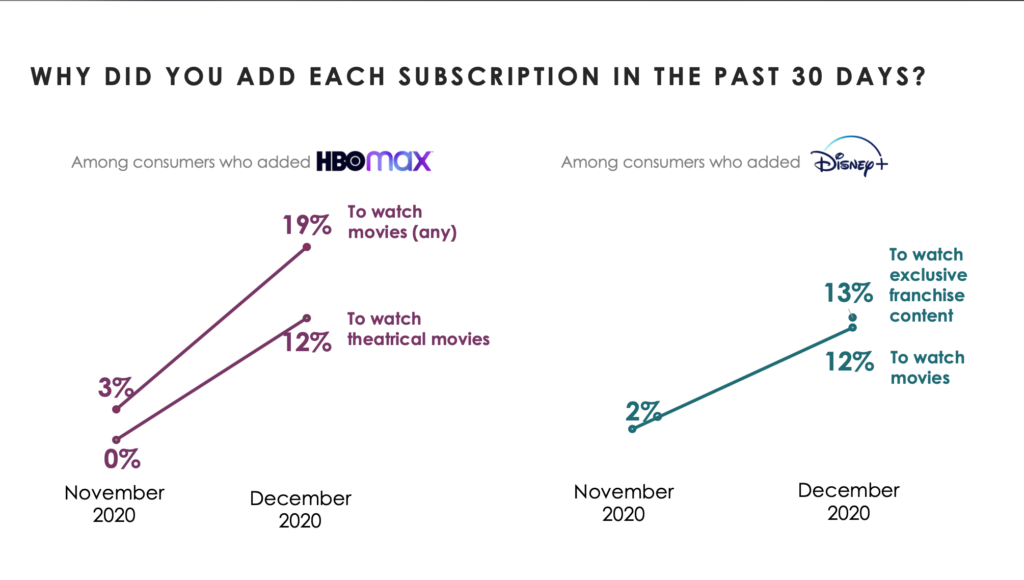

The reasons those new HBO Max subscribers gave for signing up also changed in the two months, with "watching any movies" up from 3 percent 19 percent, and "watching theatrical movies" up from zero percent to 12 percent.

In a bit of happy news for HBO Max owner WarnerMedia after the streamer's difficult first few months, the data suggests it now has a powerful differentiator to market the service going forward, particularly if it plans to keep the day-and-date release approach in place after 2021.

“It was not ideal how (HBO Max) was launched, and then at $14.99 (a month), it was a lot higher than other services out there,” said David Heger, a senior equity analyst with Edward Jones in St. Louis. “Putting movies on HBO Max, all of a sudden they have something they can market. It helped give the service a little more recognition.”

HBO Max was already starting to dig out with viewers before the announcement, after ending carriage disputes with Roku and Amazon's Fire devices, killing off confusing legacy apps, and finally launching a couple of popular originals.

As result of all that, and the theatrical releases, HBO Max subscribers doubled in the quarter to 17.7 million, and the combined HBO Max/HBO cable universe counted 39 million customers.

Disney saw somewhat similar bumps with fans of its iconic Star Wars, Pixar and Marve brands after announcing in a December investors day that it would double its programming spend, and release 80 of the planned features and series directly to Disney+.

The new slate is dominated by those iconic franchises, a major attraction for new subscribers, 13 percent of whom gave as their reason for signing up the opportunity “to watch exclusive franchise content.” The previous month, only 2 percent of new subscribers gave that reason, according to Hub.

It's not just high-end movies, or world-girdling franchises, that streaming services have to provide as streaming scales up for global audiences.

The trades were consumed this week with conversations about the push for more children's programming, because kids, it turns out, watch a lot of shows, over and over.

Apple has former Pixar and Disney animation chief John Lassiter running animation productions there, and HBO Max is beginning to gather its far-flung kids programming (and adult-oriented stuff too). One pitch from soon-to-launch Paramount+ certainly will be around Nickelodeon content.

One of the last bastions of broadcast, live news, is getting scooped up by streamers too. Tubi announced a big push into live news last week, adding dozens of local broadcast affiliates' feeds to what's now around 100 outlets on its News on Tubi section. Both ViacomCBS and NBCUniversal have scads of news ventures already, but are incorporating more of that into Paramount+ and Peacock.

Of course, all of this can be summed up in a couple of words: more and exclusive. High-quality movies, backed by a semi-traditional theatrical marketing push to beef up their event status, are one way to do it, Heger said.

“Some of the other streaming players are going to be looking at how to have more movies available, especially first run,” Heger said. “It’s going to be interesting to see after the first year if this going to be a model ongoing. (WarnerMedia) might step back to the Disney approach, where tentpole movies go to theaters first before hitting online. Beyond tentpoles, it may make sense to release (smaller films) directly to SVOD or do (day and date).”

We'll get a better sense next week how one of those smaller competitors plans to take on the Apples, Disneys, Amazons and WarnerMedias in the battle for market share.

On Wednesday, ViacomCBS executives will host an investors day to discuss plans for Paramount+, its long-in-arriving revamp of what's been called CBS All Access since it launched way back in 2014.

A flurry of ads during the CBS broadcast of the Super Bowl earlier this month spoke of the "mountain of content" planned for the service, including, yes, live news and sports, including NFL games. It can tap Paramount movies, series from MTV, BET, Comedy Central, and Nickelodeon, plus CBS's many assets.

But whether that will be enough to stand out in an already crowded streaming market is another question for ViacomCBS. The company's market capitalization is $38.7 billion.

For quick comparison, free-spending Apple has a market cap of almost $2.2 trillion. Apple's "services" unit, which includes Apple TV+, generated more $15 billion in a record last quarter.

It won't get easier for Paramount+, even with a rebrand and more programming, nor will it get any simpler for Discovery+, AMC+, the puzzling Peacock hybrid offering, or other services. But at least those services are learning what toll they must pay to drive on this road.