Esports and Advertising: The Micro and Macro Take

As The New York Times reports, all we want to do is watch each other play video games. Reporter Nellie Bowles notes, "Fortnite content, which received 2.4 billion views on YouTube in February alone, according to Tubular. So yes, people love playing video games — but people also love to watch others compete at them. Esports are, finally, just like any other sport." And therefore, brand dollars go hand-in-hand with esports, just like other sports.Below, we dive into esports TV advertising on a micro level, analyzing Turner's ELEAGUE, and on a macro level, looking at mobile gaming and video game advertising trends. Still curious? Hit us up and be sure to download our ESPORTS SNAPSHOT.

ELEAGUE

ELEAGUE is the premium esports tournament and content brand formed in partnership between Turner and IMG. The show creates globally-reaching esports events for games such as Counter Strike: Global Offensive, Street Fighter V, Overwatch and Injustice 2.

On Twitch, ELEAGUE’s major Grand Final for Counter-Strike: Global Offensive drew over 1 million concurrent viewers on its platform. While it may seem odd to watch esports competitors battle on TV, Turner is planting a flag not just on the sports side of the phenomenon, but on the culture of esports. The recent announcement of a reality TV show is just a bread crumb trail to the bigger jackpot: brand loyalty from emotionally-charged, video game-centric audiences.

Advertising Trends for Turner’s Show

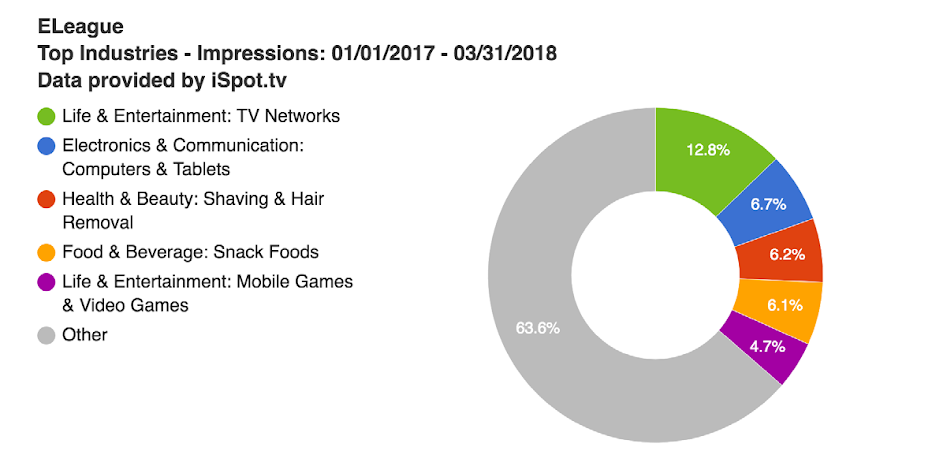

Since January 2017, Turner’s ELEAGUE show has given 179 brands the opportunity to reach the gaming audience against linear content, against an estimated $5 million spend. And while these airings generated 350 million TV ad impressions and the shows kept viewers tuned in (notice in the charts below) — the massive revenue opportunities here stretch way beyond the traditional spot. That said, below is some exclusive data from iSpot.tv showing the audience profile, the brand profiles and a bit more on the behaviors.

The industries and brands investing in TV advertising against esports

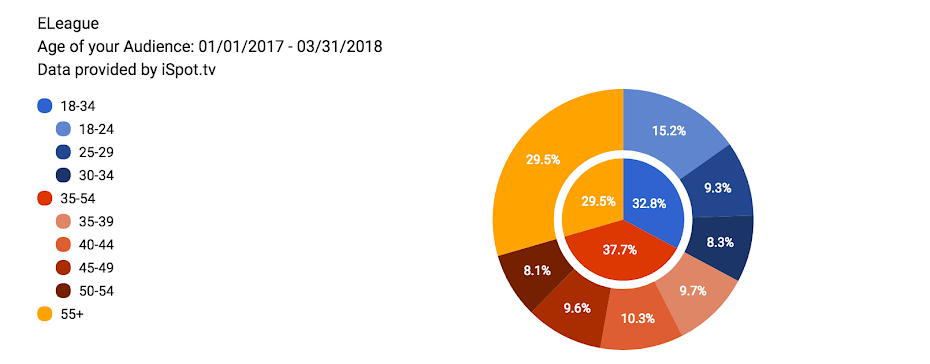

Audience Profile

With just over 70% of ad exposures happening to people under 55 years of age, the audience composite skews younger, with half of the exposures under age 44.

Ad Performance Trends are Strong

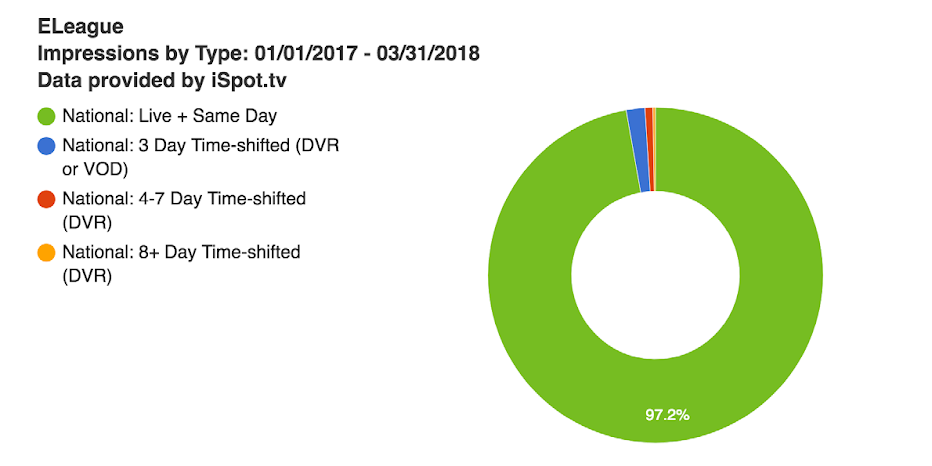

esports viewing—or advertising thereof looks a lot like other sporting events. People are glued to the live linear experience. 97% of all ads against eLeague programming is live or same day. Pictured below, 90% of ad exposures are viewed at least 75% of the way through.

ESPORTS ON TELEVISION

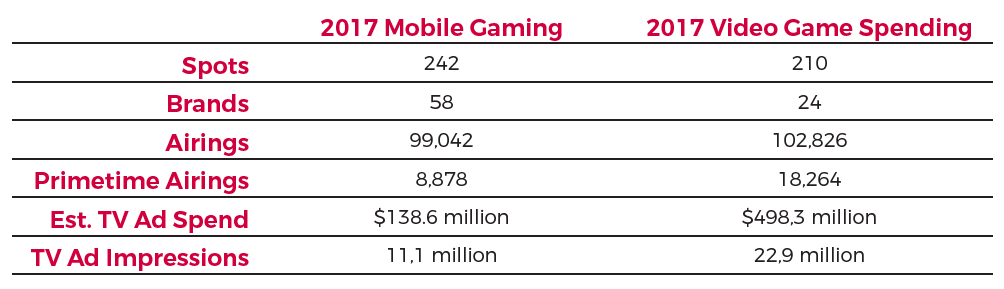

As a contrast here’s a macro view of the gaming industry’s advertising on linear TV in 2017, breaking down mobile vs. traditional console gaming per iSpot.tv, a real-time TV ad measurement company with attention and conversion analytics from more than 8 million smart TVs.

While mobile gaming has, perceptively, a larger base audience (all mobile device users) to broadcast to, traditional console video game ad spend and impressions still outpaces by a factor of 3-to-1. Mobile gaming has grown the audience of total “gamers” over time, however, the core competency of the gaming industry — and where esports has thrived most — is with console gaming audiences. Console games don’t just lend to more vivid content (via streaming and linear TV), but also a more vibrant in-person experience for viewers (as evidenced further by the attendance numbers from Katowice this year).

+Industry Commentary

Ed Tomasi Managing Director, esports at Big Block

Historically, most of the brands we see advertise against esports programming are endemic to the industry, but a new crop of brands and agencies are beginning to invest in esports advertising and branded content development. Smart agencies are going to earn competitive advantages here by embracing the esports audience rather than trying to fit them into a box they’ve already established. The most effective agencies and brands will be ones that harness an insider’s perspective on esports and put their brand in that endemic light. With a healthy and growing community of creators around gaming, it makes perfect sense to migrate toward custom, native advertising within esports.

Alan Wolk Lead Analyst & Editor, TV[R]EV

While Turner has had much success with esports related programming, it’s important to note that they’re not actually showing games—they’re showcasing personalities and all the behind the scenes action, giving dimension to the players and making them accessible to a broader audience. In many ways it’s similar to what “WWE Wives” did for professional wrestling. Now the reason that games don’t show up on TV is that few tournament-style games actually work as live TV—they’re hard to follow, don’t have many breaks and just aren’t geared for the medium. Game developers know this and have tried to develop games that work well on TV, but thus far, the ones they’ve come up with have not been particularly fun to play. Whoever cracks that code: creating a game that’s fun to play and makes for exciting TV is going to have a huge hit on their hand. Not to mention millions of dollars. With that kind of incentive, it won’t be long.

David Bloom Analyst, TV[R]EV

These ad spends, concentrated on mass-market console titles, suggest the massive scale of that portion of the game business. Esports typically focus on PC-based titles (though we’re seeing a big jump in mobile tournament play on titles such as Blizzard’s Hearthstone). That’s even though the PC market is relatively small, because most major developers create console versions of those games too, and then drive interest across all platforms with broad advertising.

A huge push by publishers on the mass-market console versions of their hit titles feeds into interest in the PC-based versions of those same games, as well as esports tournaments related to the games. It’s somewhat similar to Chevrolet, Ford, Goodyear and Quaker State spending money on NASCAR racing teams, then selling much less specialized technologies to a mass audience of non-pro drivers.